SUMMARY

Subsidising fossil fuels and related infrastructure is a barrier to decarbonization of electricity and must cease immediately. Beyond direct subsidies, unequal treatment, such as less stringent reliability standardsreliability standards A measure of security of supply most often expressed in terms of LOLE, set where marginal cost of additional capacity equals the benefit it provides., creates hidden subsidies for fossil fuels. Continuing to subsidise fossil fuels confers legitimacy on subsidies for clean alternatives even before any consideration of the pricing of real environmental externalities. Where fossil fuel subsidies have been adopted in the interest of vulnerable consumers, they should be replaced with fuel-neutral targeted social programmes.

WHAT

Removing barriers to replacing fossil fuels

HOW

Cease direct and indirect fossil fuel support

WHO

Member States

WHEN

Immediately

Subsidising fossil fuels drives up the cost of transitioning to a decarbonised power system. Their direct cost is compounded by market externalities — climate disruption and other environmental damage and related loss of social welfare caused by burning fossil fuels.

Fossil fuel subsidies take many forms. The most pervasive subsidy is implicit: the ability to produce and burn fossil fuels without paying for those externalities. Pollution control policies, including carbon pricing and taxation, are steps towards reducing this implicit subsidy, but their reach and intensity are so far very limited (see Pricing GHG Emissions factsheet).

Explicit subsidies through avenues like tax policy and public spending are more region specific and varied in their rationale. Tax benefits that reduce the costs of domestic fossil fuel exploration and production are often justified with security of supply and employment arguments. Government assistance to fossil fuel technology research and development by domestic companies is often justified on industrial policy grounds.

Fossil fuels are often subsidised by public financial support for fossil infrastructure such as gas and oil pipelines or liquid natural gas terminals. Spending public money on such investment for reasons of security of supply and affordability needs to be weighed against the near certainty of stranded investment in the transition to a decarbonized energy system.

To the extent fossil fuel subsidies are deployed in service of laudable social policy goals, such as making critical energy services more affordable for disadvantaged consumers, such goals are more effectively pursued through fuel-neutral targeted social programmes rather than by promoting perverse energy market outcomes across the board (see Equitable Social Outcomes and Market-Based Retail Prices factsheets). Using subsidies to keep oil and gas cheap for political goals is a familiar ploy of populist governments. All lead to the same end — uneconomic growth in the use of fossil fuels and in ever-ballooning cleanup costs.

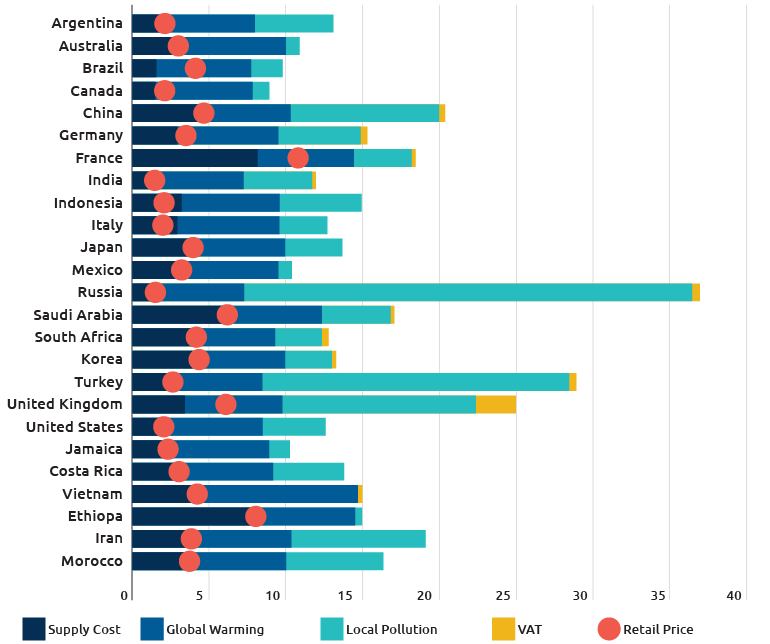

Fuel price flaws

Most countries underprice fuels, particularly coal and natural gas. Countries can subsidize fuels in two ways: undercharging for the product (explicit subsidies) and for the cost of the damage done to the environment (implicit subsidies).

(current and efficient coal prices in 2020, $US per gigajoule)

International Monetary Fund. (2021). Fuel price flaws.

Key Recommendations

- Document and publicise all direct and indirect subsidies to the fossil fuel industry, including subsidies for the use and disposal of the industry’s products.

- Immediately remove all direct and indirect public subsidies for fossil fuels. Where this might result in a price shock to consumers, the public resources that had accrued to the benefit of fossil fuel interests can be redirected to consumers (e.g., through progressive tax benefits) to offset the immediate impact and then phased out over time.

- Where fossil fuel subsidies are deployed in service of valid public policy goals, replace them with targeted social programmes designed to achieve the same ends, to eliminate perverse energy market outcomes and enable more effective public scrutiny.

References and Further Reading

- International Monetary Fund. (2021). Fuel price flaws [LinkedIn post].

- Parry, I., Simon, B., & Vernon, N. (2021). Still not getting energy prices right: A gobal and country update of fossil fuel subsidies. International Monetary Fund.

- Published:

- Last modified: August 13, 2024

Quick guide on how to use this website:

Quick guide on how to use this website: