SUMMARY

Here, we focus on the social impacts that result from how power system decarbonisation policies are implemented and financed. When designing policy for the clean energy transition — including tariff structures, levies, taxes and renewable energy and energy efficiency programmes — there is increasing focus on directing the benefits of the transition to protect low-income, energy-poor and vulnerable customers and to address structural and income inequalities.

WHAT

Energy justice and wider societal priorities

HOW

Design equitable policies that share costs and distribute benefits

WHO

EU and national policy makers and regulators

WHEN

Ongoing but crucial decisions following Fit for 55 Package

It is essential that the energy transition not only successfully decarbonises the power system but also supports equitable outcomes for citizens and other energy users. Currently, some individuals and communities suffer from a range of energy inequities, including a lack of access to clean and sustainable energy sources, lack of affordable energy or local environmental impacts of fossil-based electricity and heat generation. In EU policy, the growing prominence of the concept of energy poverty is placing increased focus on the energy burdens for different energy users. Although on average, low-income customers tend to consume less energy compared to their higher-income counterparts, energy costs represent a higher proportion of their overall household budget. Even slight increases in costs can have a devastating impact. This impact is exacerbated by inequities from other sectors, such as finance, transport and food, which stack on top of one another in low-income and marginalised communities

The energy transition offers opportunities to address existing inequities, improving health and quality of life, starting with the most vulnerable.

To achieve equitable outcomes, policymakers must focus on:

Avoiding unnecessary system costs for all through implementing the Energy Efficiency First principle and by ensuring that market rules, pricing and tariff structures promote the most efficient use of the system and route to decarbonisation (See Market-Based Retail Prices, Smart Network Tariffs and Scarcity Pricing factsheets).

Fairly distributing costs among different types of energy users and within household user groups. When some energy users are exempted from network or levies, the financial burden for nonexempted users increases, and exempted users are insulated from important cost drivers for energy efficiency and demand response. Most commonly, energy intensive users are exempted from energy system costs, which increases burdens for households, burdening those with the lowest incomes most. Within the household user class, individual households are advantaged or disadvantaged by the regulatory choices made on distribution of costs and use of price signals. As mentioned in the Smart Network Tariffs factsheet, unnecessary fixed fees should be avoided as they result in low-income households, who are more likely to be low energy users, paying more in proportion to their energy use and use of the grid. The use of price signals to influence behaviour through, for example, tariff design or carbon taxes should also be considered in relation to the ability of the energy user to respond to the price signal. Low-income households have no ability to invest in energy efficiency or renewable energy measures in response to the price signal and are often already rationing energy. For these households, energy price signals can result in further energy rationing (see Pricing GHG Emissions factsheet).

Sharing the direct and indirect benefits of energy transition policies equitably and in line with social and environmental priorities. Programmes that support investment in energy efficiency, renewable heat and power and automated demand response technologies should be directed as a priority to low-income households, where they will have the highest social impact. This is particularly important where programmes are funded through energy bill levies that increase energy burdens most for low-income customers. Levy-funded energy efficiency obligation schemes in the UK, France and Ireland ring-fence a proportion of private benefits for low-income or energy-poor households. Where carbon taxes are introduced, the revenues can be used to offset the increased cost burden for low-income and otherwise burdened households in the short term and deploy energy efficiency and renewable energy measures in the longer term. The revenues can be brought forward in time to allow investment before the price impacts through the raising of a climate bond on the basis of future revenue (see Supporting Consumer Infrastructure factsheet).

Increase access, engagement and ownership of energy system assets by low-income households. Energy system decentralisation provides opportunities for individuals and businesses to take ownership or provide services into the system. Energy communities, supported by European regulation, are perhaps the most obvious example of increased community energy asset ownership (see Energy Communities Support the Energy System factsheet). Many of these community groups have specific social objectives to involve lower income households or alleviate energy poverty in their founding principles. The principles of inclusive design — which aim to ensure that services are accessible to the widest possible range of individuals through their design for the most marginalised — can also increase engagement in the energy market by low-income households. Policies that address split incentives between landlords and tenants, for example through standards or including heat service in rents, can also help low-income households to access energy efficiency measures and smart technology.

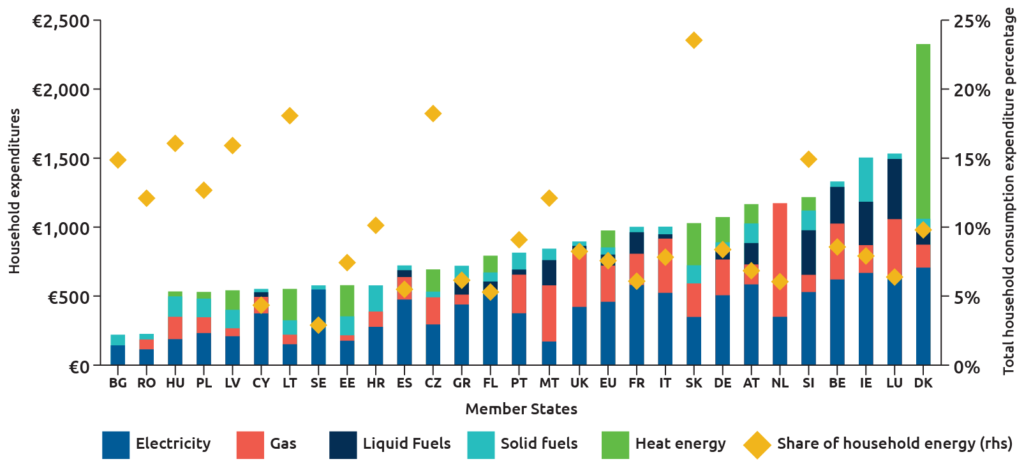

Figure 1. Expenditures on home energy for EU households in the lowest income decile

Source: European Commission (2019). Energy prices and costs in Europe.

Figure 2. Average electricity taxes as a percentage of net income and pre-tax expenditure in the 21 OECD countries

Source: Zachmann, G., Fredriksson, G. and Claeys, G. (2018). The distributional effects of climate policies. The Bruegel Blueprint Series 28.

Figure 3. High share of income on energy in Europe, 2010

Source: European Commission, Directorate General for Energy and EU Energy Poverty Observatory. (2010). High share of energy expenditure in income.

Key Recommendations

- Reduce overall costs by applying the Energy Efficiency First principle to all policy decisions.

- Conduct distributional justice reviews of existing national levies and taxes. No subsidies or cost exemptions should be permitted unless fully justified when distributional impacts are taken into account.

- Remove unnecessary fixed network fees (see Smart Network Tariffs factsheet).

- Deliver benefits of the transition to low-income households as a priority through targeting energy efficiency and RES programmes to benefit low-income households first and ring-fencing revenues from carbon pricing for investment in decarbonization and flexibility as a priority for low-income households, including those who are tenants rather than homeowners.

- Ensure policy decisions support energy communities and examine other ways to encourage increased engagement in the energy market and ownership of energy system assets.

References and Further Reading

- Sunderland, L., Jahn, A., Hogan, M., Rosenow, J., & Cowart, R. (2020). Equity in the energy transition: Who pays and who benefits? Regulatory Assistance Project.

- Sunderland, L., & Thomas, S. (2021). EU Policy Guide: The Energy Efficiency Directive Energy Savings Obligation and energy poverty alleviation. Regulatory Assistance Project for SocialWatt and ENSMOV.

- Thomas, S., Sunderland, L., & Santini, M. (2021). Pricing is just the icing: The role of carbon pricing in a comprehensive policy framework to decarbonise the EU buildings sector. Regulatory Assistance Project.

- Sunderland, L. & Gibb, D. (2022). Taking the burn out of heating for low-income households. Regulatory Assistance Project.

- European Commission (2019). Energy prices and costs in Europe.

- European Commission, Directorate General for Energy and EU Energy Poverty Observatory. (2010). High share of energy expenditure in income (2M) [database].

- Zachmann, G., Fredriksson, G. and Claeys, G. (2018). The distributional effects of climate policies. The Bruegel Blueprint Series 28. Bruegel.

- Published:

- Last modified: August 13, 2024

Quick guide on how to use this website:

Quick guide on how to use this website: