A RAP Power System Blueprint Deep Dive

Implementing nodal pricing

Dominic Scott

Introduction

- This resource explores what LMP implementation might require in Europe, in terms of roles, responsibilities and market designs, as well as some technical prerequisites

- LMP (Locational Marginal Pricing), called nodal pricing in its simplest form, entails formation of wholesale electricity prices that reflect the cost of supplying an extra unit of energy in a location (a node) given grid constraints.

- This resource seeks to demystify LMP implementation by shedding further light on analysis and research on the topic

- Analysis draws on literature and informal interviews with expert (to whom we extend thanks)

- We consider this a living resource, that will evolve with the body of research, and we invite comments ([email protected]) from experts on this resource better to present implementation challenges and solutions

- Analysis largely works with idea that nodal, if ever implemented, would be led by a single trail-blazing MS, rather than imposed across EU simultaneously, though the latter approach is also given some consideration

- Important considerations that are out of scope

- whether to apply LMP to transmission only, or also to its combination with distribution

- whether to apply only to generation or also consumption

- the theoretical business case for introducing nodal pricing

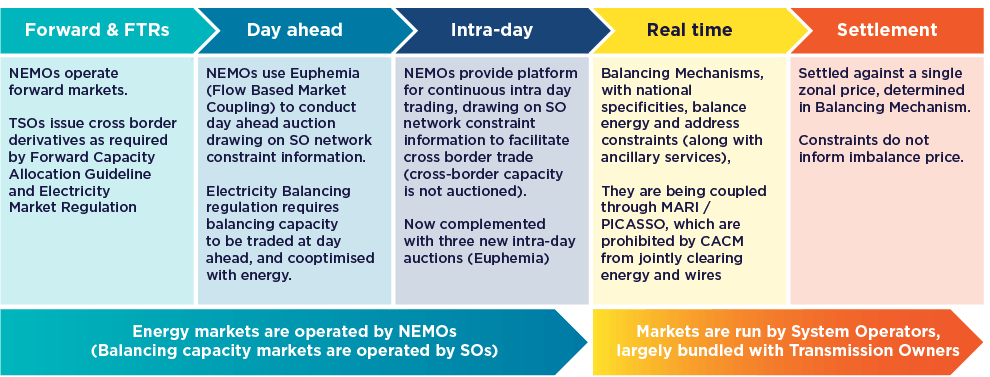

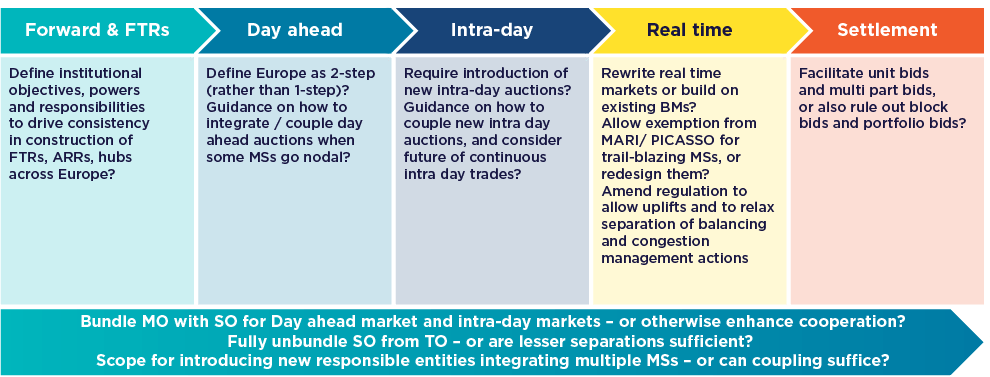

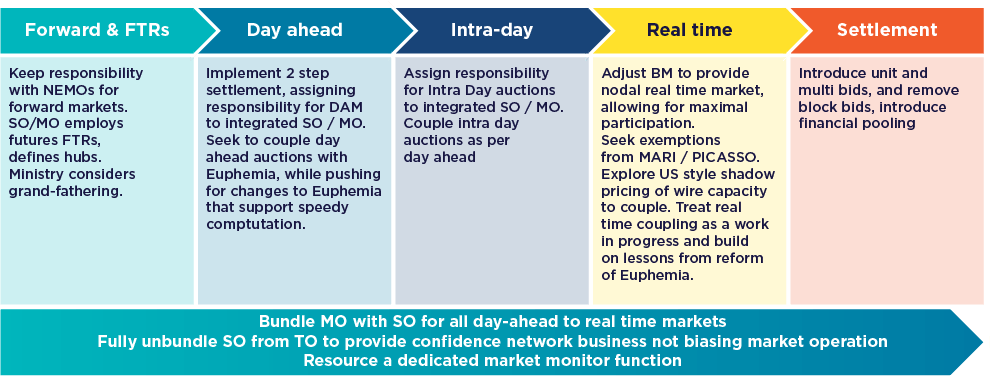

What changes are necessary or helpful to implement nodal pricing?

Forward markets and FTRs

Day ahead

Intra-day

Real-time

Settlement

Why

- FTRs usually accompany introduction of nodal pricing, on grounds of helping market participants hedge against price risk and/ or to support market efficiency. Detailed design questions to be tackled include whether to introduce FTRs and what type, whether and how to return congestioncongestion Whenever a particular element on the transmission or distribution network reaches its limit and cannot carry any more electricity. Also a situation where trade between two bidding zones cannot be fully accommodated because it would significantly affect the physical flows on network elements that cannot accommodate those flows. rent value to consumers, whether to introduce annual revenue rights (ARRs), whether to introduce a grandfathering process, and how to define hubs for trading.

How

- The regulator and the System Operator/ Market Operator need clear duties and powers to develop an accommodating regulatory framework.

- While ARRs are not in place, note EU law (Forward Capacity Allocation Guideline) already requires TSOs to issue long-term transmission rights (LTTRs), financial derivatives based on the spread between two prices (typically real time in nodal markets) in two locations. With introduction of nodal pricing, attention will be needed to ensure FTRs are of sufficient granularity of location. Attention will also be needed to selecting the optimal form of FTRTradable financial transmission right A form of insurance policy for market participants to cover additional costs incurred if and when congestion on the transmission system prevents physical delivery of electricity between two bidding zones. which could be either option (one way) and futures (two way), conventionally called FTR-options and FTR-obligations, with some academic literature pointing to spread futures as a form of FTR that supports efficient outcomes.

Resource and governance challenges

- The key challenge is for MSs and/or the EU to set policy to give power and responsibilities to the actors best placed to take these detailed implementation challenges forward in the best interests of consumers. Synergies between the SO and process of allocating wire capacity suggest a case for enhanced cooperation of the SO and MO roles, potentially integrated.

- Regulations at the European level that pertain to the current non-nodal system should be robust to a Europe that slowly transitions to nodal pricing led by a growing handful of trail-blazing Member States.

- In order to allow as many actors as possible to access such virtual hubs and zones, financial regulation – MIFID II – currently barring participation needs to be revised. Thus regulation in member states and on EU-level in MiFID II has to be adapted accordingly, so that trading of derivatives on system prices – genuine financial instruments – is allowed if a sufficiently prudent management of basis risk can be ensured.

Reading

- Neon, Cross-border Forward Markets, An assessment of the status quo and proposed reforms of European long-term transmission rights, 2024, https://neon.energy/Neon-Forward-Markets.pdf

- DIW, Electricity market design 2030 to 2050 moving towards implementation, 2021, https://synergie-projekt.de/wp-content/uploads/2020/08/SynErgie_Whitepaper_Electricity-Market-Design-2030-2050-Moving-Towards-Implementation.pdf

Unit bids

Why?

- Moving from portfolio based to unit-based bids is a critical step as it allows the expression of different (nodal) prices at different locations, scheduling at unit level, and the unlocking of accompanying efficiencies. Without it, nodal prices calculated cannot fulfil their role of locational granular price signals.

- Unit based scheduling also underpins co-optimisation which unlocks further efficiencies. Once pricing zones are sufficiently small to address structural congestionstructural congestion Congestion in the transmission system that is predictable, is geographically stable over time and is frequently reoccurring under normal power system conditions., it will be possible to resolve the artificial separation of energy products and ancillary service and balancing products.

- Unit based bids assist market monitoring. It underpins provision of information at very granular level which can be scrutinised by the market monitor.

How

- The optimal unit level representation in market schedule must be determined – typically taken to be sub-station connected distribution system with transmission system. Whichever jurisdiction is implementing nodal (a trail blazer, or entire Europe) will need to introduce unit bids.

Governance and resourcing considerations

- Requires significant resource for System Operator owing to volume of units that contribute now to portfolio positions – not same as when for example ERCOT implemented nodal. This may be less challenging for say Ireland, Italy and Greece which never moved away from unit level representation, than other such as Great Britain.

Reading

- Ashour Novirdoust, A., et al, 2021, Electricity Market Design 2030-2050: Moving Towards Implementation, https://doi.org/10.24406/fit-n-640928

- Eicke A., Schittekatte T., Fighting the wrong battle? A critical assessment of arguments against nodal electricity prices in the European debate, Energy Policy, 2022 https://www.sciencedirect.com/science/article/pii/S0301421522004396

Non-linear, multi-part bids

Why?

- Replacing complex block bids is important in underpinning speedy computation of the market clearing algorithm and identification and delivery of the least cost solution. The existing block bid approach – all-or-nothing orders of energy that bundle together multiple consecutive hours – does not allow for the most efficient solution to be identified, struggles to allow efficient bidding from new technologies like storage and DSR, and may impede speedy computation and run times (as witnessed by concerns regarding current run times of the Euphemia algorithm).

How

- Multi-part bids allow for multiple different costs to be expressed separately in bids, such as start-up costs, run costs, and ramping costs. This overcomes current deficiencies, supports welfare maximisation, and supports transparency.

Resourcing and governance considerations

- Non-linear bids require an amendment of the current bidding format methodology (CACM guidelines), which currently states that within each bidding zonebidding zone The largest geographical area within which market participants are able to trade electricity without network capacity allocation. each generator shall receive the same price during each market time unit, and which thus rules out uplifts / make whole payments.

- Existing interstate markets like Euphemia and cross border intra-day auctions do not currently accommodate multi-part bids, and so might require amend if nodal markets were to be directly included within these algorithms. They may, h0wever, need to address this regardless, given concerns regarding current run times (see Eicke et al).

Reading

- Knorr, J., et al, Zonal vs. Nodal Pricing An Analysis of Different Pricing Rules in the German day ahead, TUM Working Paper, 2024, https://arxiv.org/html/2403.09265v1

- Eicke A., Schittekatte T., Fighting the wrong battle? A critical assessment of arguments against nodal electricity prices in the European debate, Energy Policy, 2022 https://www.sciencedirect.com/science/article/pii/S0301421522004396

- Neuhoff, K., et al, EU power market reform toward locational pricing: Rewarding flexible consumers for resolving transmission constraints, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg https://www.econstor.eu/bitstream/10419/295216/1/FPM_Summary_Report_16_05_2024.pdf

Shift from physical balancing group responsibility to financial pooling

Why?

- Physical balancing group responsibility imposes redundant requirements on resources (to nominate load against injection) and impedes realisation of the benefits of nodal pricing (by hindering the expression of different prices per unit).

How?

- The introduction of financial pooling allows a given portfolio of resources to be held responsible as a group for the sum of all deviations in dispatch from the nodal central scheduling process at the relevant real time nodal price for each unit. It thus removes redundant obligations and unlocks benefits of nodal pricing.

Resourcing and governance considerations

- There is a question as to whether coordination is required at European level

Reading

- Neuhoff, K., et al, EU power market reform toward locational pricing: Rewarding flexible consumers for resolving transmission constraints, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg https://www.econstor.eu/bitstream/10419/295216/1/FPM_Summary_Report_16_05_2024.pdf

Shorten time to gate closure

Why?

- Shorter time to gate closure enables the nodal market to fulfil its potential in balancing energy and managing system constraints by drawing on almost real time information that minimises uncertainty of system conditions. Nodal pricing allows for shorter times to gate closure than other approaches, as the market addresses more of the system challenges and leaves less for the System Operator to do.

How?

- Gate closure might be shortened for instance to 5 minutes, as in effect in PJM and multiple US jurisdictions (called schedule dispatch interval)

Resource and governance considerations

- A research paper for British Government for example considers similar reforms in GB context to be not particularly challenging (even if not in context of nodal pricing, DESNZ research paper, 2023)

Reading

- Incremental reforms to wholesale electricity markets, DESNZ research paper, 2023 https://assets.publishing.service.gov.uk/media/65e3a3863f694514a3035fbf/7-arup-incremental-reforms-wholesale-electricity-markets.pdf

- Wartsila, how shorter time resolution is key to decarbonizing energy markets, 2023 https://www.wartsila.com/insights/article/how-shorter-time-resolution-is-the-key-to-decarbonising-energy-markets

Why?

- Confidence in wholesale price formation under nodal pricing, where prices are shaped by the confluence of wire capacity availability and energy cost, is necessary to earn the trust of market participants, and requires a transparently conveyed state of the art network model.

How?

- Detailed map of network configuration building on measurement and testing of capacities. This may require making data public that is today confidential, for example outage plans from TOs – the market would need to know where an outage was planned and its timing since it could impact the relative price between nodes.

Resourcing and governance considerations

- This may require increased resources for the system-market-operator.

Reading

- Antonopoulos, G., et al, Nodal pricing in the European internal electricity market, JRC, European Commission, 2020 https://publications.jrc.ec.europa.eu/repository/handle/JRC119977

Why?

- With greater granularity of location in price, the expression of market power becomes more visible and preventable, meriting an adjusted approach.

How?

- Assign responsibility for market monitoring – the market monitor could sit within the ISO, or the regulator, or be a new independent quasi-public body.

- Invigorated focus on ex ante checks for abuse of market power – notably when a constraint materialises at a node to allow a resource there to become pivotal in setting prices, typically mitigating this with a predefined cost-based pricing method

Resource and governance considerations

- The market monitor will require resources. The market monitor role could be performed within the ISO, the regulator, a new independent quasi-public body, or some combination of these.

Reading

- Market Power Mitigation Mechanisms for Wholesale Electricity Markets: Status Quo and Challenges, Graf et al, 2021, https://fsi.stanford.edu/publication/market-power-mitigation-mechanisms-wholesale-electricity-markets-status-quo-and

- Eicke A., Schittekatte T., Fighting the wrong battle? A critical assessment of arguments against nodal electricity prices in the European debate, Energy Policy, 2022 https://www.sciencedirect.com/science/article/pii/S0301421522004396

Enhanced separation of SO and TO – potentially fully unbundled

Why?

- Stakeholders will want confidence that the process of wholesale price formation, which reflects conditions under nodal pricing regime is free of conflicts of interest of the transmission network owner, for instance in generating revenue from wire build as motivated by nodal prices.

How?

- Separation of SO business from TO ownership, as in the US, and more recently GB (justified on system planning grounds rather than any link to nodal pricing).

- Lesser forms of separation than full ownership unbundlingunbundling Breaking down vertically integrated monopolies into separate legal entities (legal unbundling), or prohibiting ownership within the same corporate group (legal unbunbundling), to avoid conflicts of interest. For example, under the Electricity Directive, for power generation and retail supply are legally unbundled from distribution and ownership unbundled from transmission, subject to limited exceptions. might be considered.

Resourcing and governance considerations

- There will be strong institutional push-back to separation of the SO business from the far more lucrative TO business.

Reading

- Review of GB energy system operation, Ofgem, 2021, https://www.ofgem.gov.uk/sites/default/files/docs/2021/01/ofgem_-_review_of_gb_energy_system_operation_0.pdf

Why?

- Although the EU is already moving towards 15 minute settlement periods (under the Electricity Balancing guideline), nodal pricing may facilitate further reductions in settlement period duration. This can provide more accurate price signals that send necessary signals for flexibility needed to accommodate the increasingly variable forms of energy supply as the system decarbonises.

How?

- Reduction of settlement periods to for example 5 minutes, as in NYISO, PJM, and Australia

Resource and governance considerations

- Research for the British Government for example consider similar reforms in GB context to be not particularly challenging (even if not in context of nodal pricing, DESNZ research paper, 2023)

Reading

- Incremental reforms to wholesale electricity markets, DESNZ research paper, 2023 https://assets.publishing.service.gov.uk/media/65e3a3863f694514a3035fbf/7-arup-incremental-reforms-wholesale-electricity-markets.pdf

- Wartsila, how shorter time resolution is key to decarbonizing energy markets, 2023 https://www.wartsila.com/insights/article/how-shorter-time-resolution-is-the-key-to-decarbonising-energy-markets

Implement nodal optimisation algorithm: 2 step settlement?

Why?

- A decision needs to be taken whether to introduce a settlement model of one step (real time nodal market) or more steps a two step market incorporates a nodal auction at day ahead (see for example JRC).

How?

This decision could be taken at the level of the trail-blazing MS, or it could be taken at EU level, in order to facilitate compatibility with a desired target model.

-

- The merit of conducting an additional nodal auction at day ahead is greater with the more resources on the system that need long warm-up times – Europe currently has plenty.

- On the other hand, academic analysis suggests that firm day ahead markets may facilitate the exercise of market power (Leautier).

- A day ahead auction could be accompanied with further intra-day nodal auctions, noting three new intra day auctions have recently been introduced.

- Other decisions are required including

- Determination of nodal resolution – for instance 850 nodes are modelled for GB (Compass Lexecon). California has 10,000 nodes.

- Determination of marginality of price – for instance reflecting at the margin of 1KWh or 1MWh (see Pollitt for example)

- Determination of which parties it applies to and whether there should be exemptions for certain groups

- Form of non-linear pricing to be employed – for example Convex Hull Pricing or Integer Programming Pricing (see DIW, and Knorr et al)

Resourcing and governance considerations

- The EU may wish to consider defining a nodal Target Model to guide reform efforts by trail-blazers.

- Reform is required of the current bidding format methodology under the CACM guidelines – which states that within each bidding zone each generator shall receive the same price during each market time unit, which rules out uplifts / make whole payments.

- Reform or exemption from elements of 4th energy package which mandated differentiation between balancing actions and congestion management actions may be required.

- It may be necessary to accommodate opportunity cost pricing to support efficient arbitrage between day ahead and real time markets, although (JRC) it is suggested that existing arrangements may already allow for this

- System-Market-Operator may need more resource to implement and settle a system with many more prices and covering new markets

Reading

- Antonopoulos, G., et al, Nodal pricing in the European internal electricity market, JRC, European Commission, 2020 https://publications.jrc.ec.europa.eu/repository/handle/JRC119977

- FTI Consulting & Energy Systems Catapult, Assessment of locational wholesale electricity market design options in GB, October 2023 https://www.fticonsulting.com/uk/insights/videos-and-podcasts/assessment-locational-wholesale-electricity-market-design-options

- Leautier T., Imperfect markets and imperfect regulation, 2018, Chapter 3 from Enron with love

- Pollitt, M., Locational Marginal Prices (LMPs) for Electricity in Europe? The Untold Story EPRG Working Paper 2318, Cambridge Working Paper in Economics, 2023 https://www.eprg.group.cam.ac.uk/wp-content/uploads/2023/07/text-2318-revised-180723.pdf

- Policy Exchange, Powering Net Zero Why local electricity pricing holds the key to a Net Zero energy system, 2020, https://policyexchange.org.uk/wp-content/uploads/2022/10/Electricity-Market-Design.pdf

Couple nodal market with neighbours ahead of real time

Why?

- Efficient coupling is necessary to unlock the benefits of the internal European market.

How?

- Day ahead and intra-day cross border auctions – options

- Option1. Couple directly within the existing Euphemia-based algorithms (ideal) and adding further intra-day auctions closer to real time. Euphemia style algorithms (day ahead and intra day) will require amend to incorporate multi-part bids (arguably necessary anyway) and unit bidding formats may need to change across Europe to accommodate nodal pricing

- Option 2. Separate clearing of trail-blazing nodal Member State, with amends to facilitate trade with the remainder of the Euphemia market.

- Either way, attention will be required to ensure exports from nodal regions do not aggravate congestion in zonal regions and to treat the issue of loop flows appropriately (see Neuhoff et al).

Resourcing and governance considerations

- Nodal pricing requires cooperation between system operation and market operation activities within and potentially across jurisdictions (particularly were the whole of Europe to move together to nodal pricing), and raises the questions of whether the two activities should be bundled together, and whether the new entities should be integrated across jurisdictions.

Reading:

- Neuhoff, K., et al, EU power market reform toward locational pricing: Rewarding flexible consumers for resolving transmission constraints, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg https://www.econstor.eu/bitstream/10419/295216/1/FPM_Summary_Report_16_05_2024.pdf

- Future Power Market platform https://www.diw.de/de/diw_01.c.436553.de/projekte/future_power_market_platform.html

Bundle SO with MO – or otherwise enhance cooperation

Why?

- Integration of system operation (SO) with market operation (MO) may support speedy and accurate calculation of nodal prices (which hinge on the interaction of these two roles), and similarly facilitate cooptimisation of energy and reserves, helping in both cases to unlock efficiency gains of both. In the US, market operation role is typically undertaken by the ISO (or RTO).

How?

- Assign responsibility from NEMO to integrated MO-SO, or otherwise institutionalise enhanced cooperation

Resource and governance considerations

- Status quo bias may need to be overcome, particularly by NEMOs who may resist change owing to a perceived existential threat

Reading

- Ofgem, Assessment of Locational Wholesale Pricing for Great Britain, 2023 https://www.ofgem.gov.uk/sites/default/files/2023-10/Ofgem%20Report%20-%20Assessment%20of%20Locational%20Pricing%20in%20GB%20%28final%29.pdf

Multiple FTR design questions

Why

- FTRs usually accompany introduction of nodal pricing, on grounds of helping market participants hedge against price risk and/ or to support market efficiency. Detailed design questions to be tackled include whether to introduce FTRs and what type, whether and how to return congestion rent value to consumers, whether to introduce annual revenue rights (ARRs), whether to introduce a grandfathering process, and how to define hubs for trading.

How

- The regulator and the System Operator/ Market Operator need clear duties and powers to develop an accommodating regulatory framework.

- While ARRs are not in place, note EU law (Forward Capacity Allocation Guideline) already requires TSOs to issue long-term transmission rights (LTTRs), financial derivatives based on the spread between two prices (typically real time in nodal markets) in two locations. With introduction of nodal pricing, attention will be needed to ensure FTRs are of sufficient granularity of location. Attention will also be needed to selecting the optimal form of FTR which could be either option (one way) and futures (two way), conventionally called FTR-options and FTR-obligations, with some academic literature pointing to spread futures as a form of FTR that supports efficient outcomes.

Resource and governance challenges

- The key challenge is for MSs and/or the EU to set policy to give power and responsibilities to the actors best placed to take these detailed implementation challenges forward in the best interests of consumers. Synergies between the SO and process of allocating wire capacity suggest a case for enhanced cooperation of the SO and MO roles, potentially integrated.

- Regulations at the European level that pertain to the current non-nodal system should be robust to a Europe that slowly transitions to nodal pricing led by a growing handful of trail-blazing Member States.

- In order to allow as many actors as possible to access such virtual hubs and zones, financial regulation – MIFID II – currently barring participation needs to be revised. Thus regulation in member states and on EU-level in MiFID II has to be adapted accordingly, so that trading of derivatives on system prices – genuine financial instruments – is allowed if a sufficiently prudent management of basis risk can be ensured.

Reading

- Neon, Cross-border Forward Markets, An assessment of the status quo and proposed reforms of European long-term transmission rights, 2024, https://neon.energy/Neon-Forward-Markets.pdf

- DIW, Electricity market design 2030 to 2050 moving towards implementation, 2021, https://synergie-projekt.de/wp-content/uploads/2020/08/SynErgie_Whitepaper_Electricity-Market-Design-2030-2050-Moving-Towards-Implementation.pdf

Implement nodal optimisation algorithm in real time

Why?

- Nodal pricing requires adoption of an algorithm that implements nodal pricing principles.

How?

- Implementation of a centrally determined security constrained economic dispatch algorithm, likely making use of uplift payments to facilitate necessary computation speeds. This in turn requires reform of the current bidding format methodology under the CACM guidelines which states that within each bidding zone each generator shall receive the same price during each market time unit, which rules out uplifts / make whole payments, and reform or exemption from elements of 4th energy package which mandated differentiation between balancing actions and congestion management actions.

- Multiple other decisions must be taken including

- Determination of nodal resolution – for instance California has 10,000 nodes, and 850 nodes have been modeled for GB (see Compass Lexecon).

- Determination of marginality of price – for instance reflecting at the margin of 1KWh or 1MWh (see Pollitt).

- Determination of which parties it applies to and whether there should be exemptions for certain groups.

- Determination of whether to use exist Balancing Mechanism or to start afresh (see JRC).

- Form of non-linear pricing to be employed – for example Convex Hull Pricing or Integer Programming Pricing (see DIW, first report)

Resourcing and governance considerations

- Reform of the current bidding format methodology under the CACM guidelines – which states that within each bidding zone each generator shall receive the same price during each market time unit, which rules out uplifts / make whole payments

- Reform or exemption from elements of 4th energy package which mandated differentiation between balancing actions and congestion management actions

- System-Market-Operator may need more significantly more resource to implement and settle a system with many more prices

Reading

- Antonopoulos, G., et al, Nodal pricing in the European internal electricity market, JRC, European Commission, 2020 https://publications.jrc.ec.europa.eu/repository/handle/JRC119977

- Ashour Novirdoust, A., et al, 2021, DIW, Electricity Spot Market Design 2030-2050, https://doi.org/10.24406/fit-n-621457

- FTI Consulting & Energy Systems Catapult, Assessment of locational wholesale electricity market design options in GB, October 2023 https://www.fticonsulting.com/uk/insights/videos-and-podcasts/assessment-locational-wholesale-electricity-market-design-options

- Knorr, J., et al, Zonal vs. Nodal Pricing An Analysis of Different Pricing Rules in the German day ahead, TUM Working Paper, 2024, https://arxiv.org/html/2403.09265v1

- Leautier T., Imperfect markets and imperfect regulation, 2018, Chapter 3 from Enron with love

- Pollitt, M., Locational Marginal Prices (LMPs) for Electricity in Europe? The Untold Story EPRG Working Paper 2318, Cambridge Working Paper in Economics, 2023 https://www.eprg.group.cam.ac.uk/wp-content/uploads/2023/07/text-2318-revised-180723.pdf

- Policy Exchange, Powering Net Zero Why local electricity pricing holds the key to a Net Zero energy system, 2020, https://policyexchange.org.uk/wp-content/uploads/2022/10/Electricity-Market-Design.pdf

Couple nodal market with neighbours in real time

Why?

- Efficient coupling is necessary to deliver low-cost supplies

How?

- Real time – options

- Option 1. Cross-European nodal option: Introduce new European Euphemia style market applied at nodal level, in real time and with uplifts. Replace Mari and Picasso, which do not jointly optimise with wires.

- Option 2. Trail blazer MS nodal option: market clearing of trail blazing nodal Member State is cleared separately from rest of European real time market and coupling algorithms are employed. Trail blazing MS is exempt from Mari and Picasso.

Resourcing and governance considerations

- Depending on the approach, this raises the question of integration of system and market operation across jurisdictions in Europe to cover larger geographical areas.

- Amends (option 1) or exemptions (option 2) from the 4th energy package which mandated differentiation between balancing actions and congestion management actions are required.

- Further research is merited to explore relative merits of real time coupling approaches.

Reading:

- Neuhoff, K., et al, EU power market reform toward locational pricing: Rewarding flexible consumers for resolving transmission constraints, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg https://www.econstor.eu/bitstream/10419/295216/1/FPM_Summary_Report_16_05_2024.pdf

- Future Power Market platform https://www.diw.de/de/diw_01.c.436553.de/projekte/future_power_market_platform.html

Concluding themes

Essential building blocks include

- adjusting bidding formats to allow for more locationally precise unit bids (rather than aggregated to portfolio) and

- adjusting bidding formats to allow for more sophisticated expression of non-linear costs in multi bids in auctions (rather than requiring parties to boil down their sophisticated cost structure into a single price, potentially blocked across multiple periods), and introduction of up-lift payments

- introduction of financial pooling, which allows a given portfolio of resources to be held responsible as a group for the sum of all deviations in dispatch from the nodal central scheduling process at the relevant real time nodal price for each unit.

These building blocks may not only be necessary to facilitate nodal pricing, but even to make the most of a modest shift to more granular zones, and potentially even to simply assure the practicability of existing coupling algorithms.

Nodal pricing raises governance questions, such as allocation of roles and responsibilities, bundling and unbundling to address synergies and conflicts, including:

- Bundling of the SO and MO – nodal pricing strengthens the synergies of enhanced cooperation

- Unbundling of SO and TO – nodal pricing may heighten concerns of conflicts that come with current integration

- Integrating and /or coupling across MSs of SO+MOs – how best to couple markets in real time is one of the biggest challenges

- Which entity is best placed to take on the role of market monitor

Existing regulations requiring attention:

- CACM guidelines – which states that within each bidding zone each generator shall receive the same price during each market time unit, which rules out uplifts / make whole payments

- elements of 4th energy package which mandated differentiation between balancing actions and congestion management actions (and which have shaped development of Mari and Picasso products)

- MIFID II – impedes trade of derivatives

There is a growing wealth of research and expertise to draw on – see bibliography – and further resource and attention is merited to questions like coupling, particularly in real time.

The EU may wish to consider how the Target Model could be adapted to guide reform efforts by trail-blazers, which could help ensure the development of roles and responsibilities, markets and auctions are future proof if and when MSs follow a trail-blazer

CACM

The Guideline on Capacity Allocation and Congestion Management sets out the methods for calculating how much capacity market participants can use on cross border lines without endangering system security. It also harmonises how cross border markets operate in Europe. CACM is the cornerstone of a European single market for electricity. See ENTSO-E

Euphemia

EUPHEMIA (short for Pan-European Hybrid Electricity Market Integration Algorithm) is the market-clearing algorithm for European single day-ahead coupling (SDAC). The algorithm is used to calculate energy allocation and electricity prices across 27 European countries. See here.

FTR

Financial Transmission Rights are derivatives linked to the difference in price spread between two prices (typically real time in nodal markets) in two locations.

ISO

When the task of system Operation is conducted by an entity that is unbundled from transmission ownership

MARI

Manually Activated Reserves Initiative. The MARI platform operates auctions for the exchange of balancing energy from manual frequency restoration reserves (mFRR)

NEMO

Nominated Electricity Market Operator. Run power exchanges for the trade of wholesale electricity.

PICASSO

PICASSO is the Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation. It is the project to establish a common European energy activation market for aFRR-energy.

MIFID II

Markets in Financial Instruments Directive 2014, commonly known as MiFID 2, is a legal act of the European Union. Together with Regulation No 600/2014 it provides a legal framework for securities markets, investment intermediaries, in addition to trading venues . See here

MO

Market operator – the entity that provides the market platform, currently conducted by NEMOs for markets ahead of real time, and by TSOs for balancing mechanisms (real time)

SO

System Operator – the entity charged with managing the grid, currently typically bundled with transmission ownership (TSOs) in Europe.

TSO

Transmission System Operator – Transmission System Operator (TSO) is an organisation responsible for the efficient and reliable transmission of electricity from generation plants via the power grid to regional or local electricity distribution operators. Roles and responsibilities of TSOs in the European framework include to control and operate the transmission grid and transport electricity to regional or local distribution networks, to connect networks with neighboring countries and regulate cross-border electricity flows, to ensure safe, reliable, and efficient energy supply, and to provide non-discriminatory access to networks for all stakeholders. See here

Antonopoulos, G., et al, Nodal pricing in the European internal electricity market, JRC, European Commission, 2020 https://publications.jrc.ec.europa.eu/repository/handle/JRC119977

Ashour Novirdoust, A., et al, 2021, Electricity Market Design 2030-2050: Moving Towards Implementation, https://doi.org/10.24406/fit-n-640928

Ashour Novirdoust, A., et al, 2021, DIW, Electricity Spot Market Design 2030-2050, https://doi.org/10.24406/fit-n-621457

DESNZ research paper, Incremental reforms to wholesale electricity markets, 2023 https://assets.publishing.service.gov.uk/media/65e3a3863f694514a3035fbf/7-arup-incremental-reforms-wholesale-electricity-markets.pdf

Eicke A., & Schittekatte T., Fighting the wrong battle? A critical assessment of arguments against nodal electricity prices in the European debate, Energy Policy, 2022 https://www.sciencedirect.com/science/article/pii/S0301421522004396

ENTSO-E, Report on the Locational Marginal Pricing Study of the Bidding Zone Review Process, 2022, https://eepublicdownloads.entsoe.eu/clean-documents/Publications/Market%20Committee%20publications/ENTSO-E%20LMP%20Report_publication.pdf

Future Power Market platform https://www.diw.de/de/diw_01.c.436553.de/projekte/future_power_market_platform.html

FTI Consulting, Energy Systems Catapult, Assessment of locational wholesale electricity market design options in GB, October 2023 https://www.fticonsulting.com/uk/insights/videos-and-podcasts/assessment-locational-wholesale-electricity-market-design-options

Graf et al, Market Power Mitigation Mechanisms for Wholesale Electricity Markets: Status Quo and Challenges, 2021, https://fsi.stanford.edu/publication/market-power-mitigation-mechanisms-wholesale-electricity-markets-status-quo-and

Kirschen, D., & Strbac, G,., Fundamentals of power system economics, section 5,4,2 Co-optimisation of energy and ancillary services

Knorr, J., et al, Zonal vs. Nodal Pricing An Analysis of Different Pricing Rules in the German day ahead, TUM Working Paper, 2024, https://arxiv.org/html/2403.09265v1

Leautier T., Imperfect markets and imperfect regulation, 2018, Chapter 3 from Enron with love

Neon, Cross-border Forward Markets, An assessment of the status quo and proposed reforms of European long-term transmission rights, 2024, https://neon.energy/Neon-Forward-Markets.pdf

Neuhoff, K., et al, EU power market reform toward locational pricing: Rewarding flexible consumers for resolving transmission constraints, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg https://www.econstor.eu/bitstream/10419/295216/1/FPM_Summary_Report_16_05_2024.pdf

Ofgem, Review of GB energy system operation, 2021, https://www.ofgem.gov.uk/sites/default/files/docs/2021/01/ofgem_-_review_of_gb_energy_system_operation_0.pdf

Ofgem, Assessment of Locational Wholesale Pricing for Great Britain, 2023 https://www.ofgem.gov.uk/sites/default/files/2023-10/Ofgem%20Report%20-%20Assessment%20of%20Locational%20Pricing%20in%20GB%20%28final%29.pdf

OMIE, Electricity Market, accessed June 2024, https://www.omie.es/en/mercado-de-electricidad#:~:text=Every%20day%20of%20the%20year,hours%20of%20the%20next%20day.

Policy Exchange, Powering Net Zero Why local electricity pricing holds the key to a Net Zero energy system, 2020, https://policyexchange.org.uk/wp-content/uploads/2022/10/Electricity-Market-Design.pdf

Pollitt, M., Locational Marginal Prices (LMPs) for Electricity in Europe? The Untold Story EPRG Working Paper 2318, Cambridge Working Paper in Economics, 2023 https://www.eprg.group.cam.ac.uk/wp-content/uploads/2023/07/text-2318-revised-180723.pdf

Thomassen, G., Fuhrmanek, A., Cadenovic, R., Pozo Camara, D. and Vitiello, S., Redispatch and Congestion Management, Publications Office of the European Union, Luxembourg, 2024, doi:10.2760/853898, JRC137685 .

Wartsila, how shorter time resolution is key to decarbonizing energy markets, 2023 https://www.wartsila.com/insights/article/how-shorter-time-resolution-is-the-key-to-decarbonising-energy-markets

The author thanks Bram Claeys, Mike Hogan, Zsuzsanna Pato, Monika Morawiecka and Tim Simard for comments on various drafts. Thanks also go to Brandon Hunt for web design, and to many external experts for input. All errors are the author’s own.

- Last modified: July 26, 2024

Quick guide on how to use this website:

Quick guide on how to use this website: